Monetization project | Acko Insurance

A GTM Strategy for Acko Insurance

User Journey and Touchpoints

I’ll map the user journey for Acko Insurance, identifying key stages and touchpoints where communications can effectively engage users (leveraging user calls & the information from it).

User Journey Stage | Description | Touchpoints | Target Segment (ICP) |

|---|---|---|---|

Awareness | User discovers Acko via Play Store, ads, or word of mouth. | Play Store listing, social media ads (e.g., Instagram, YouTube). | New Users (Harsh, Karan – Claim-Focused Users). |

Onboarding | User signs up and explores the app for the first time. | In-app onboarding (Steps 1-11), welcome email. | New and Casual Users (Harsh, Karan). |

Activation | User purchases a policy or engages with core features (e.g., policy check, claim filing). | In-app pop-ups, push notifications, email campaigns. | Core Users (Bhakti, Lalit – Frequent Policy Managers). |

Engagement | User interacts regularly (e.g., bi-weekly policy checks, claim filing). | In-app banners, push notifications, SMS. | Core and Power Users (Bhakti, Lalit, reward-driven users). |

Retention | User renews policies or adds new products (e.g., health insurance). | Renewal reminders, cross-sell emails, loyalty offers. | All Users, especially Inactive Users (Rajeev). |

GTM Communications

I’ll develop communications for each touchpoint, addressing the four key questions: What Acko is?, How it builds trust, Why the customer should choose Acko?, and How to best use the product?. The communications will leverage Acko’s “Instant Claim Assurance” hook (24-hour claim settlement promise) and be tailored to the Indian market’s priorities (e.g., affordability, trust).

Touchpoint | Communication | What Your Product Is | How It Builds Trust | Why Choose Your Product | How to Best Use Your Product | Target Segment (ICP) |

|---|---|---|---|---|---|---|

Play Store Listing | “Acko Insurance: Fast, Simple, Paperless – Claims Settled in 24 Hours!” (App description headline). | Acko is a digital-first insurance app for vehicle, health, and more. | Trusted by 78M+ users, 4.6 Play Store rating. | Fastest claims (24 hours), 100% cashless, paperless process – better than traditional insurers. | Download now, sign up in 2 minutes, and explore affordable policies instantly. | New Users (Harsh, Karan). |

Onboarding Pop-Up (Step 7) | “Welcome to Acko! See How We Settle Claims in 24 Hours – Start Exploring!” (Interactive demo). | Acko offers seamless insurance with a 24-hour claim promise. | See a real-time claim demo – we deliver on our promise! | Unlike others, Acko settles claims in 24 hours with no paperwork. | Tap through the demo, then explore policies to find the best fit for you. | New and Casual Users (Harsh, Karan). |

Push Notification (Day 3) | “Hi [Name], Buy Your First Policy with a 7-Day Free Cancellation – Trust Acko’s 24-Hour Claims!” | Acko provides insurance with a fast, paperless claim process. | 7-day free cancellation reduces risk; 78M+ users trust us. | Faster claims and better prices than competitors like Policybazaar. | Tap to buy your first policy – cancel within 7 days if needed! | New and Casual Users (Harsh, Karan). |

In-App Banner (Home Screen) | “Add Health Insurance Today – Save 10% and Enjoy 24-Hour Claims!” | Acko lets you bundle vehicle and health insurance seamlessly. | Proven 24-hour claim settlement – trusted by millions. | Comprehensive coverage with faster claims than LIC or others. | Tap to add health insurance in 2 minutes and save 10%! | Core Users (Bhakti, Lalit). |

Renewal Email (30 Days Before Expiry) | “Hi [Name], Renew with Acko and Save 5% – Trust Our 24-Hour Claims!” | Acko offers easy policy renewals with a paperless process. | 4.6 rating, 24-hour claims – we keep our promises. | Save more and get faster claims compared to traditional insurers. | Click to renew in 1 minute and manage your policy in-app! | All Users, especially Inactive (Rajeev). |

Why This GTM Strategy Works for Acko

- User Journey Alignment: The communications cover all stages (Awareness to Retention), ensuring users receive consistent messaging at key touchpoints (e.g., Play Store for awareness, in-app banners for engagement). This aligns with Acko’s app-based model and Indian users’ digital behavior (e.g., high smartphone usage).

- Addressing Key Questions:

- What my Product Is?: Clearly defines Acko as a digital-first insurance app with a 24-hour claim promise, making it relatable for Indian users seeking simplicity.

- How It Builds Trust?: Highlights trust signals (e.g., 78M+ users, 4.6 rating, 24-hour claims demo), addressing Indian users’ trust concerns in a competitive market (e.g., vs. Policybazaar, LIC).

- Why Choose Acko?: Emphasizes Acko’s USPs (e.g., 24-hour claims, paperless process, better pricing), positioning it as a better choice than traditional insurers or aggregators.

- How to Best Use Acko?: Provides clear CTAs (e.g., “tap to buy,” “renew in 1 minute”), ensuring Indian users can easily navigate Acko’s app.

3 Experiments Free-to-Paid Conversion, Cross-Selling, and Up-Selling

I’ll create three experiments: one focused on free-to-paid conversion, one on cross-selling, and one on up-selling. Each experiment will leverage Acko’s “Instant Claim Assurance” hook (24-hour claim settlement promise) to drive conversions, using personalized offers and nudges tailored to user behavior. My strategy includes the learnings of onboarding teardown & how to leverage the E&R to the end goal of monetization.

Experiment Name | Goal | Target Segment | Strategy | Offer | Success Metric |

|---|---|---|---|---|---|

Free-to-Paid Starter Push | Convert free users to paid by encouraging first policy purchase, increasing subscription rate from 3% to 5%. | New and Casual Users who haven’t purchased a policy (e.g., Harsh, Karan – Claim-Focused Users). | Post-onboarding nudge (Step 11): Show a pop-up after the 24-hour claim demo – “Get started with your first policy! Buy now and save 10%.” Follow up with a push notification 3 days later: “Don’t miss out – your 10% discount expires soon!” | 10% discount on first policy purchase (e.g., vehicle insurance). | Subscription rate (target: 5%), conversion rate from nudge (target: 20%). |

Cross-Sell Health Bundle | Cross-sell health insurance to vehicle insurance holders, increasing cross-sell rate by 5%. | Core Users with existing vehicle insurance (e.g., Bhakti, Lalit – Frequent Policy Managers). | In-app banner on the home screen: “Protect your health too! Add health insurance to your vehicle plan and get 100 Acko Coins.” Follow up with an email 7 days later: “Hi [Name], bundle your health insurance with Acko – claim in 24 hours!” | 100 Acko Coins for adding health insurance within 14 days. | Cross-sell rate (target: 5% increase), banner click-through rate (target: 15%). |

Upsell Premium Coverage | Upsell higher coverage plans to existing policyholders, increasing average revenue per user (ARPU) by 10%. | Power Users with basic policies (e.g., reward-driven users, potentially Bhakti, Lalit if they’ve purchased). | Personalized email campaign: “Hi [Name], upgrade to our premium plan for comprehensive coverage – settle claims in 24 hours! Get 5% off your upgrade.” Follow up with a push notification 5 days later: “Upgrade now for better protection!” | 5% discount on upgrading to a premium plan (e.g., higher coverage, add-ons). | ARPU increase (target: 10%), upgrade conversion rate (target: 10%). |

Why These Experiments Make Sense for Acko

- Free-to-Paid Starter Push: Targets New and Casual Users (e.g., Harsh, Karan), who are likely to churn early (78% by D1, per retention data). The 10% discount and post-onboarding nudge address their need for affordability (a key value for Claim-Focused Users) and leverage the “Instant Claim Assurance” hook to build trust, encouraging a first policy purchase.

- Cross-Sell Health Bundle: Focuses on Core Users (e.g., Bhakti, Lalit), who engage monthly and value convenience (from ICP insights). Cross-selling health insurance aligns with their need for comprehensive protection, while Acko Coins incentivize action, a tactic that resonates with Indian users who value rewards (per engagement campaigns).

- UpSell Premium Coverage: Targets Power Users, who are highly engaged (bi-weekly to weekly) and more likely to invest in premium offerings. The 5% discount and emphasis on 24-hour claims cater to their desire for better coverage and trust, increasing ARPU while maintaining engagement.

Substitute Pricing for Acko Insurance

JTBD: Analyze substitute pricing for Acko Insurance to determine a pricing strategy that aligns with its Core Value Proposition (CVP), identifies what customers are paying for, highlights key product aspects, evaluates Acko’s competitive edge over substitutes, and positions the product to maximize monetization in the Indian market.

Acko’s Core Value Proposition

Protect what matters with Acko – affordable, instant insurance that’s simple, fast, and paperless. Get 24-hour claim settlements, 100% cashless coverage, and manage everything from your app, trusted by over 78M users.

What Are Acko's Customers Paying For?

Customers pay for insurance policies (e.g., vehicle, health) through Acko, and the underlying value they’re purchasing aligns with the CVP:

- Affordable Protection: Competitive pricing for vehicle, health, and other insurance policies

- Speed and Convenience: 24-hour claim settlements and a paperless, app-based process that eliminates traditional hassles (e.g., physical paperwork, long claim cycles).

- Trust and Reliability: Acko’s credibility (78M+ users, 4.6 Play Store rating) and 100% cashless coverage ensure users feel secure in their purchase.

- Ease of Management: The ability to manage policies, file claims, and explore new products in-app, saving time and effort.

What Are the Aspects of Acko That Matter Most to Your Users?

I’ll identify the aspects of Acko that resonate most with users (based on ICP insights, churn reasons, and CVP), focusing on pricing these elements:

- Ease of Use: Users like Bhakti and Lalit (Frequent Policy Managers) value the intuitive app interface (e.g., 2-minute signup, per onboarding teardown) and paperless process, which eliminates traditional insurance complexities.

- Speed (24-Hour Claims): Harsh and Karan (Claim-Focused Users) prioritize fast claim settlements, a key differentiator in the Indian market where competitors often take 7-15 days.

- Affordability: All segments (e.g., Harsh, Karan, Bhakti, Lalit) seek competitive pricing, a critical factor in India’s price-sensitive market.

- Convenience: The app-based management (e.g., policy checks, claim filing) appeals to tech-savvy Indian users, reducing the need for in-person interactions.

- Trust: The 78M+ user base and 4.6 rating build trust, especially important for Inactive Users like Rajeev, who may have switched due to competition.

Pricing Focus: Acko should price for speed (24-hour claims) and convenience (app-based, paperless), as these are the most valued aspects, while ensuring affordability remains competitive to appeal to price-sensitive Indian users.

Where Does Acko Stand Out Compared to Substitutes?

I’ll compare Acko to substitutes in the Indian insurance market (e.g., traditional insurers like LIC, digital aggregators like Policybazaar) to identify where Acko excels, allowing us to charge a premium for these aspects.

Aspect | Acko Insurance | Substitutes (e.g., LIC, Policybazaar) | Where Acko Stands Out |

|---|---|---|---|

Claim Settlement Speed | 24-hour claim settlements. | 7-15 days (traditional insurers like LIC), 3-5 days (Policybazaar). | Fastest claim settlement in the market, a key trust factor. |

Process | 100% paperless, app-based management. | Often requires paperwork (LIC), or app + agent support (Policybazaar). | Fully digital, paperless process – maximum convenience. |

Pricing | Competitive (e.g., up to 85% off on car insurance). | Competitive but varies (Policybazaar aggregates, LIC premiums can be higher). | Affordable with discounts, but not the cheapest due to added value. |

Coverage | 100% cashless coverage, flexible plans. | Cashless but often partial (LIC), varies by provider (Policybazaar). | Seamless cashless experience, reducing out-of-pocket costs. |

Trust | 78M+ users, 4.6 rating, digital-first. | LIC: High trust (legacy brand), Policybazaar: 4.5 rating, aggregator trust. | Strong digital trust (78M+ users), but less legacy trust than LIC. |

Standout Aspects for Pricing: Acko excels in speed (24-hour claims) and convenience (paperless, app-based), which substitutes like LIC and Policybazaar don’t fully match. These aspects justify a slight premium, as Indian users value fast claims and digital ease, especially in urban areas.

How Should Acko Position Themselves?

Based on the substitute analysis, Acko’s positioning should emphasize its standout features (speed, convenience) while maintaining affordability to compete in the Indian market. I’ll also consider the CVP and user needs to craft a positioning statement and pricing strategy.

Positioning Statement:

“Acko Insurance: The Fastest, Most Convenient Way to Protect What Matters – 24-Hour Claims, D2C, 100% Paperless, at Affordable Prices.”

- Why This Positioning?

- Fastest (Speed): Highlights 24-hour claim settlements, a key differentiator over substitutes (e.g., LIC’s 7-15 days).

- Most Convenient: Emphasizes the paperless, app-based process, appealing to tech-savvy Indian users (e.g., Bhakti, Lalit) who value ease.

- Affordable Prices: Ensures competitiveness in a price-sensitive market, addressing user needs (e.g., Harsh, Karan).

- Protect What Matters: Ties to the CVP, resonating emotionally with users seeking reliable insurance.

Pricing Strategy:

- Charge a Slight Premium for Speed and Convenience: Price Acko’s policies 5-10% above the market average for vehicle and health insurance, justified by the 24-hour claim settlement and paperless process. For example, if the average vehicle insurance premium in India is ₹5,000 annually (based on typical market rates in 2025), Acko could charge ₹5,250-₹5,500, emphasizing the added value.

- Maintain Affordability with Discounts: Offer introductory discounts (e.g., 10% off first policy, as in the GTM strategy) to attract price-sensitive users (e.g., Harsh, Karan), ensuring Acko remains competitive with players like Policybazaar and gets an edge against their aggregator pricing.

- Bundle Pricing for Cross-Selling: Provide bundled discounts (e.g., 5% off when adding health insurance to vehicle insurance) to encourage cross-purchases, appealing to Core Users (e.g., Bhakti, Lalit) who value comprehensive coverage.

- Freemium Elements for Engagement: Allow free app usage (e.g., policy exploration, claim tracking) to drive engagement, charging only for policy purchases or premium plans (e.g., higher coverage), supporting bi-weekly interaction goals.

Monetization Litmus Test for Acko Insurance

Conducting a monetization litmus test for Acko Insurance, focusing on its core product insurance policies (e.g., vehicle, health) to assess readiness for monetization by evaluating Retention, Depth of Engagement, and Willingness to Pay. This test will determine if Acko can effectively monetize its insurance offerings while supporting engagement and retention goals (e.g., 10% D30 retention, 5% conversion rate) in the Indian market.

A) Retention

- Flattening Retention Curve: Users decline initially but usage (policy renewals, claims) continues over time (e.g., Y time = 1 year for insurance renewals).

- Smile-Shaped Retention Curve: Users return for renewals, and the number of users increases over time (e.g., Y time = 1 year).

Analysis:

In the insurance industry, retention is typically measured by policy renewals (e.g., annual renewals for vehicle/health insurance). From the Retention Design section, the Indian insurance market has an 88% annual retention rate (12% churn), reflecting high renewal rates due to necessity (e.g., mandatory vehicle insurance) and trust.

- Acko’s Retention:

- Annual Policy Retention: Acko aligns with the industry standard (88% annual retention, per Retention Design), meaning 88% of policyholders renew annually. This translates to a flattening retention curve over a 1-year period (Y = 1 year), as the majority of users continue their policies after the initial purchase.

- App-Based Retention (D1-D30): While the app’s retention curve is downward (D1: 22%, D7: 14%, D30: 8%), this measures app usage, not policy retention. For insurance, the relevant metric is policy renewals, not daily app interactions.

- Interpretation: Acko’s insurance product (policies) shows a flattening retention curve at 88% annually, as most users renew their policies after the first year. However, there’s no smile-shaped curve, as the number of users doesn’t increase over time (e.g., new policy purchases are limited by the 3% conversion rate, per GTM experiments).

- Result: Partial Pass – Acko meets the flattening retention curve criterion (88% annual policy retention), but not the smile-shaped curve, as new user acquisition (e.g., free-to-paid conversions) isn’t increasing significantly over time.

B) Depth of Engagement

- High Engagement Frequency: Users interact frequently with the insurance product (e.g., renewals, claims, policy additions).

- Uses Multiple Features: Users engage with various insurance-related actions (e.g., purchasing policies, filing claims, cross-buying).

- High Transaction Value: Users spend significantly on policies (e.g., premiums, add-ons).

Analysis (Focused on Insurance Policies):

Engagement Frequency:

- Policy Purchases/Renewals: Most users engage annually (e.g., vehicle insurance renewals), with some Core Users (e.g., Bhakti, Lalit) adding policies semi-annually (e.g., health insurance cross-sell).

- Claims: Claim-Focused Users (e.g., Harsh, Karan) file claims 1-2 times per year (event-driven).

- Assessment: Frequency is low (annual to semi-annual), as insurance interactions are event-driven, not daily/weekly. This fails the high-frequency criterion for insurance products, which typically don’t require frequent engagement beyond renewals and claims.

Feature Usage (Breadth):

- Policy Purchases: All segments (e.g., Harsh, Karan, Bhakti, Lalit) purchase policies (e.g., vehicle, health).

- Claims Filing: Used by Claim-Focused Users (e.g., Harsh, Karan) and some Core Users (e.g., Bhakti, Lalit).

- Cross-Selling/Up-Selling: Core Users (Bhakti, Lalit) and Power Users engage in cross-sells (e.g., health insurance) and up-sells (e.g., premium plans).

- Assessment: Users engage with multiple features (purchases, claims, cross-sells), especially Core and Power Users, meeting this criterion.

Transaction Value:

- Policy Premiums: Vehicle insurance (₹5,000 annually), health insurance (₹3,000 annually), premium plans (~₹7,000 annually, per Substitute Pricing).

- Assessment: Transaction value is high for Core and Power Users (e.g., ₹8,000+ annually with cross-sells), but lower for Casual Users (e.g., Harsh, Karan) who may only purchase one policy (~₹5,000). This partially meets the high transaction value criterion, as only a subset of users (40%) contribute significantly.

Result: Pass – Acko meets the feature usage criterion (multiple insurance actions) and partially meets transaction value (high for Core/Power Users), but fails on engagement frequency (annual/semi-annual, not bi-weekly). Insurance products naturally have lower interaction frequency, so this is expected.

C) Core + Power Users > 50% of Total Users

- ICPs:

- Exploratory New Buyers: First-time buyers exploring options (e.g., young professionals).

- Claim-Focused Users: Engage primarily for claims (e.g., Harsh, Karan).

- Frequent Policy Managers: Regularly manage policies (e.g., Bhakti, Lalit).

- Inactive Users: Disengaged users (e.g., Rajeev).

- Select Qualifying ICPs (Core + Power Users):

- Core Users: Frequent Policy Managers (Bhakti, Lalit) – purchase and renew policies (annually), engage with cross-sells (e.g., health insurance).

- Power Users: Purchase multiple policies (vehicle + health), up-sell to premium plans, high transaction value (e.g., ₹8,000+ annually).

- Identify Their Problems:

- Core Users (Frequent Policy Managers): Need convenience (e.g., Bhakti: faster support) and ongoing value (e.g., Lalit: clearer claim updates), but may not cross-purchase frequently.

- Power Users (Reward-Driven Users): Seek rewards and comprehensive coverage, but may not fully utilize premium plans (e.g., add-ons).

- Testing the Hypothesis:

- Hypothesis: Core + Power Users (Frequent Policy Managers, Reward-Driven Users) make up >50% of Acko’s total policyholders, indicating strong monetization potential.

- Test: Using segmentation and industry context:

- Casual Users (Exploratory New Buyers, Claim-Focused, Inactive): ~55% (one-off purchases, claims-only, or churned).

- Core Users (Frequent Policy Managers): ~35% (consistent renewals, some cross-sells).

- Power Users (Reward-Driven): ~10% (multiple policies, up-sells).

- Result: Core (35%) + Power (10%) = 45% of total policyholders, below 50%. Acko fails this criterion, as the majority are Casual Users with lower transaction value (e.g., one policy, ~₹5,000 annually).

- Validation: The 88% annual retention rate supports renewals among Core Users, but the 3% conversion rate (GTM experiments) indicates limited new policy purchases, keeping Core + Power Users below 50%.

- Scale Your Sample Set:

- Current State: Acko has 78M+ users, with 70M policyholders (assuming 90% have purchased at least one policy). Core + Power Users = 45% (31.5M policyholders), Casual Users = 55% (~38.5M).

- Scaling Plan:

- Target: Increase Core + Power Users to >50% (e.g., 55%, or ~38.5M policyholders) by August 2025.

- Actions:

- Use GTM strategies (e.g., in-app banners, emails) to encourage cross-sells (e.g., health insurance) and up-sells (e.g., premium plans), converting Casual Users into Core/Power Users.

- Leverage the 24-hour claim promise to drive renewals and new purchases, increasing transaction value.

- Timeline: Start scaling on May 16, 2025, monitor monthly, and reassess by August 16, 2025.

Result: Fail (If we go by definition) – Core + Power Users (45%) are below the 50% threshold, indicating that the majority of policyholders aren’t high-value users yet.

Is Acko Effectively Achieving Monetization?

- Strengths:

- Retention (Policies): The 88% annual retention rate aligns with the Indian insurance market (per Retention Design), indicating strong policy renewals. This suggests users are willing to pay for Acko’s insurance products over time, supporting monetization through renewals (e.g., ~₹5,000 annual premiums).

- Transaction Value: Core and Power Users (45% of policyholders) contribute high transaction value (e.g., ₹8,000+ annually with cross-sells/up-sells), driving revenue through policy purchases, cross-sells (e.g., health insurance), and up-sells (e.g., premium plans, per GTM experiments).

- Value Proposition: Acko’s CVP (24-hour claims, paperless process) justifies a 5-10% premium (Substitute Pricing), and the 78M+ user base builds trust, encouraging willingness to pay among Indian users.

- Weaknesses:

- Low Conversion: The 3% free-to-paid conversion rate (GTM experiments) indicates limited new policy purchases, restricting revenue growth. The majority of users (Casual, 55%) don’t engage beyond one-off purchases or claims.

- Engagement Frequency: Insurance interactions are event-driven (annual renewals, 1-2 claims/year), failing the high-frequency criterion. This limits opportunities for cross-sells/up-sells, as users don’t interact frequently enough to encounter offers.

- User Distribution: Core + Power Users (45%) are below 50%, meaning the majority of policyholders (Casual Users) contribute lower revenue (e.g., one policy, ~₹5,000 annually).

Acko is moderately effective at achieving monetization through its insurance products. The high annual retention (88%) and strong transaction value from Core + Power Users (45%) support revenue through renewals and cross-sells/up-sells. However, low new user conversion (3%), event-driven engagement (annual/semi-annual), and a limited Core + Power User base (45% vs. >50%) restrict overall monetization potential. Acko is monetizing effectively among its high-value users but struggles to scale this across its entire user base.

Recommendations to Improve Monetization

- Increase Conversion: Enhance GTM strategies (e.g., push notifications, 7-day free cancellation) to boost free-to-paid conversions from 3% to 5%, targeting Casual Users (e.g., Harsh, Karan) to drive new policy purchases.

- Encourage Frequent Interactions: Introduce non-event-driven engagement (e.g., bi-weekly policy check reminders, rewards for app interactions) to increase touchpoints for cross-sells/up-sells, even if insurance usage remains annual.

- Grow Core + Power Users: Scale Core + Power Users to >50% (e.g., 55%, ~38.5M policyholders) by August 2025 through cross-sell/up-sell experiments (e.g., Health Insurance Bundle, Premium Plan Upgrade), converting Casual Users into high-value segments.

- Reinforce CVP: Continue emphasizing the 24-hour claim promise and paperless process in all communications to justify the 5-10% premium, building willingness to pay among Indian users.

Summary

When focusing on insurance policies, Acko Insurance partially passes the monetization litmus test, with a flattening retention curve (88% annual retention), moderate engagement (multiple features used, high transaction value for 45% of users, but low frequency), and a Core + Power User base of 45% (below 50%). Acko is moderately effective at monetizing through renewals and high-value users (Core + Power), but low conversion rates (3%), event-driven engagement (annual/semi-annual), and a limited high-value user base restrict scalability. To improve, Acko should increase conversions, encourage more frequent interactions, and grow its Core + Power User base by August 2025, leveraging its CVP to drive revenue in the Indian market.

Monetization Design for Acko Insurance

Connecting Monetization to Litmus Test and User Insights

Acko Insurance’s monetization strategy builds on the Litmus Test (partial pass), which showed strong annual policy retention (88%), engagement with multiple features (e.g., purchases, claims, cross-sells), and high transaction value among Core and Power Users (45% of policyholders).

Challenges include low conversion (3%), event-driven engagement (annual/semi-annual), and a Core + Power User base below 50%. User insights (e.g., Bhakti, Lalit: value convenience) and Acko’s loyalty-driven approach (e.g., rewarding repeat customers, per the Medium article) emphasize targeting high-value, loyal users for monetization. This step will identify whom to charge among Core and Power Users, focusing on maximizing revenue and retention in the Indian market.

Laying Down the Baseline Scenario

- Total Policyholders: ~70M (90% of 78M+ users, per prior steps).

- User Distribution (From RFM Analysis):

- Core Users (Frequent Policy Managers, e.g., Bhakti, Lalit): 35% (~24.5M policyholders).

- Power Users (Reward-Driven Users): 10% (~7M policyholders).

Revenue Potential: Core and Power Users are Acko’s primary revenue drivers due to their consistent policy purchases, renewals, cross-sells, and up-sells.

Testing Their Elasticity – RFM Analysis

I’ll use the RFM Analysis to evaluate Core and Power Users’ suitability for monetization, focusing on their loyalty and engagement to determine whom to charge.

Segment | Recency (Recent Buyer?) | Frequency (How Often?) | Monetary (Ticket Value vs. Avg) | Churn Risk | Revenue Potential |

|---|---|---|---|---|---|

Core Users | Medium – Renew annually, some cross-sells (e.g., Bhakti, Lalit). | Medium – Annually to semi-annually (renewals + cross-sells). | Medium – Higher than average (vehicle + health cross-sells). | Low – Loyal, renew consistently (88% annual retention). | High – Steady renewals, potential for cross-sells. |

Power Users | High – Recent purchases (e.g., up-sells, cross-sells). | High – Bi-weekly app interactions, annual renewals + add-ons. | High – Highest value (multiple policies, premium plans). | Very Low – Highly engaged, reward-driven, least likely to churn. | Very High – High transaction value, frequent purchases. |

Plotting RFM Analysis

- Champions: Power Users – High Recency, High Frequency, High Monetary. Lowest churn risk, highest revenue potential.

- Loyalists: Core Users – Medium Recency, Medium Frequency, Medium Monetary. Low churn risk, good revenue potential.

Defining "Whom to Charge"

Based on the RFM Analysis, Acko will charge both Core and Power Users, as they are the most loyal and valuable segments, ensuring high revenue potential with minimal churn risk.

Whom to Charge:

- Power Users (Champions): Charge this segment due to their high loyalty (lowest churn risk), frequent engagement (bi-weekly app interactions), and high transaction value (multiple policies, premium plans). They are Acko’s most valuable users, consistently purchasing and up-selling (e.g., premium plans, per GTM experiments), making them ideal for monetization.

- Core Users (Loyalists): Charge this segment due to their good loyalty (low churn risk), consistent renewals (annually), and potential for cross-sells (e.g., health insurance). They engage regularly (annually to semi-annually) and contribute steady revenue through renewals, making them a reliable monetization target.

Why Charge These Segments?

- Power Users: Their high engagement and transaction value ensure maximum revenue with minimal churn risk. They’re reward-driven and value Acko’s convenience (e.g., paperless process, 24-hour claims), making them likely to continue purchasing (e.g., renewals, up-sells).

- Core Users: Their consistent renewals (88% annual retention) and potential for cross-sells (e.g., adding health insurance) provide a stable revenue stream. They value convenience (e.g., Bhakti, Lalit: frequent policy managers) and are less likely to churn, supporting long-term monetization.

- Why Not Others?: We’re focusing solely on Core and Power Users, as they represent Acko’s most engaged and loyal segments, aligning with the goal of monetizing high-value users while minimizing churn.

Why This Approach Aligns with Acko’s Strategy

- Loyalty Focus: Targeting Core and Power Users aligns with Acko’s strategy of rewarding repeat customers (per the Medium article), ensuring low churn and high lifetime value in India’s competitive insurance market (88% annual retention).

- Revenue Maximization: Both segments have high transaction value (Core: steady renewals, cross-sells; Power: multiple policies, up-sells), making them ideal for monetization.

- Indian Market Fit: Focusing on loyal users leverages India’s high policy renewal rates (88%), ensuring consistent revenue while minimizing churn risk.

Alignment with Acko’s Goals

- Monetization: Charging Core and Power Users maximizes revenue through renewals, cross-sells, and up-sells, supporting the 5% conversion rate target (for new purchases) and increasing ARPU (e.g., 10% target, per GTM experiments).

- Retention: Targeting loyal users ensures low churn, supporting the 10% D30 retention goal and maintaining the 88% annual policy retention rate.

Summary

Acko Insurance will charge Core Users (Frequent Policy Managers, e.g., Bhakti, Lalit) and Power Users (Reward-Driven Users), as identified by the RFM Analysis, due to their loyalty, low churn risk, and high transaction value. Core Users provide steady revenue through renewals and cross-sells, while Power Users maximize revenue with frequent purchases and up-sells, aligning with Acko’s loyalty-driven strategy and India’s high-retention insurance market (88% annual retention). This approach supports Acko’s monetization (5% conversion) and retention (10% D30) goals.

Determining the optimal point to charge Core and Power Users by identifying Aha Moments (when users first experience core value) and Happy Moments (when users experience recurring value), ensuring Perceived Value exceeds Perceived Price.

Identifying Which Aspect Determines Value for Your Product

I’ll determine the aspects of Acko’s insurance product (policies) that provide the most significant benefits to Core Users (Frequent Policy Managers, e.g., Bhakti, Lalit) and Power Users (Reward-Driven Users), using the four goal types: Functional, Personal, Financial, and Social.

- Functional Goal:

- Core Users: Manage policies seamlessly (e.g., check status, renewals, add family details) via the app, reducing the hassle of traditional insurance processes (e.g., paperwork, agent visits).

- Power Users: File claims quickly (24-hour settlements) and manage multiple policies (e.g., vehicle + health) in one app, streamlining insurance tasks.

- Value: Acko’s paperless, app-based process (per CVP: “simple, fast, paperless”) saves time and effort, a key functional benefit.

- Personal Goal:

- Both Segments: Gain peace of mind through reliable insurance coverage (e.g., 100% cashless, 24-hour claims), ensuring protection for what matters (e.g., family, vehicle).

- Value: Acko’s CVP (“Protect what matters”) and trust signals (78M+ users, 4.6 rating) provide emotional security, enhancing quality of life.

- Financial Goal:

- Core Users: Save money through loyalty discounts (e.g., 10% off after 1 year, per prior step) and NCB (e.g., 20% after 1 claim-free year).

- Power Users: Maximize savings with higher discounts (e.g., 25% off after 3 years), NCB (up to 50%), and rewards (e.g., via CRED partnership).

- Value: Acko’s discounts and rewards (per Medium article) directly address India’s price-sensitive market, offering financial benefits.

Primary Value Aspect: The most significant benefit for Core and Power Users is the Financial Goal (saving money through discounts, NCB) and Functional Goal (convenience of a paperless, app-based process with 24-hour claims). These align with Acko’s CVP (“affordable, instant insurance”) and user priorities (e.g., Bhakti, Lalit: convenience; Power Users: rewards).

Competitor Benchmarking

I’ll assess Acko’s benefits against competitors (e.g., LIC, Policybazaar) to identify differentiation, value at similar/lower pricing, and the next best alternative.

Aspect | Acko Insurance | LIC (Traditional Insurer) | Policybazaar (Aggregator) | Differentiation/Value Offered |

|---|---|---|---|---|

Claim Settlement Speed | 24-hour settlements, 100% cashless. | 7-15 days, partial cashless. | 3-5 days, varies by provider. | Acko’s fastest claims (24 hours) save time, a key functional benefit. |

Process Convenience | Paperless, app-based management. | Requires paperwork, in-person visits. | App-based but often needs agent support. | Acko’s fully digital process offers superior convenience. |

Pricing/Discounts | Loyalty discounts (e.g., tiered, NCB), competitive premiums (market avg ~₹5,000). | Higher premiums, limited discounts. | Aggregates competitive prices, some discounts. | Acko offers better savings via loyalty discounts (e.g., NCB, CRED rewards). |

Trust | 78M+ users, 4.6 rating, digital-first. | High legacy trust, slower processes. | 4.5 rating, aggregator trust. | Acko matches digital trust, but LIC has stronger legacy trust. |

- Do Benefits Match?: Acko matches Policybazaar on digital convenience and competitive pricing but exceeds both LIC and Policybazaar on claim speed (24 hours vs. 3-15 days) and paperless processes.

- What’s Different?: Acko’s 24-hour claim settlements and loyalty-driven discounts (e.g., tiered, NCB) provide more functional (time savings) and financial (cost savings) value than competitors.

- More Value at Similar/Lower Offering?: Acko can offer more value (faster claims, better discounts) at a similar market price (~₹5,000 annual premium), making it attractive to Core and Power Users.

- Next Best Alternative: If not Acko, Policybazaar is the next best alternative due to its competitive pricing and digital interface, though it lacks Acko’s speed and discount depth.

Quantify Results Ensuring Alignment with Price

I’ll quantify the Perceived Value for Core and Power Users based on the primary aspects (Financial and Functional Goals), ensuring alignment with the Perceived Price (market avg ~₹5,000 annual premium).

- Financial Goal (Money Saved):

- Core Users: Loyalty discounts (e.g., 10% off after 1 year) and NCB (e.g., 20% after 1 claim-free year) save ~₹1,500 annually on a ₹5,000 premium (assuming combined discounts).

- Power Users: Higher discounts (e.g., 25% off after 3 years), NCB (up to 50%), and CRED rewards (e.g., 5%) save ~₹3,000 annually on a ₹5,000 premium.

- Quantified Value: Core Users: ₹1,500 saved/year; Power Users: ₹3,000 saved/year.

- Functional Goal (Time Saved):

- Claim Filing: Acko’s 24-hour claim settlement vs. Policybazaar (3-5 days) or LIC (7-15 days) saves ~5-10 days per claim. Assuming 1 claim/year, this is ~5-10 days saved annually.

- Policy Management: Paperless process saves ~2 hours per interaction (e.g., renewals, cross-sells) vs. traditional methods (LIC: 4-5 hours with paperwork). Core Users (2 interactions/year) save ~4 hours; Power Users (4 interactions/year) save ~8 hours.

- Quantified Value: Core Users: 5 days (claims) + 4 hours (management); Power Users: 10 days (claims) + 8 hours (management).

Mapping Perceived Value Across the User Journey

Homepage

- Content: The homepage greets the user ("Hey Dhruv") and offers quick access to "Your Acko Essentials" (Policies, Vehicles, Family, Rewards) and an "Explore Insurance" section with a car insurance offer ("Get up to 85% off on car insurance", "Save as much as ₹40,000").

- Perceived Value:

- Convenience: Centralized access to essential features (policies, vehicles, etc.) simplifies user navigation.

- Cost Savings: The car insurance offer highlights significant savings (up to 85% off, ₹40,000), appealing to cost-conscious users.

- Aha Moment: The Aha Moment here is the realization of potential cost savings on car insurance. The prominent discount ("Get up to 85% off") and specific savings amount (₹40,000) create a strong first impression of value, encouraging the user to explore further.

The Home Page does not hold back in highlighting the benefits & discounts which increase the chances of users taking the next step!!

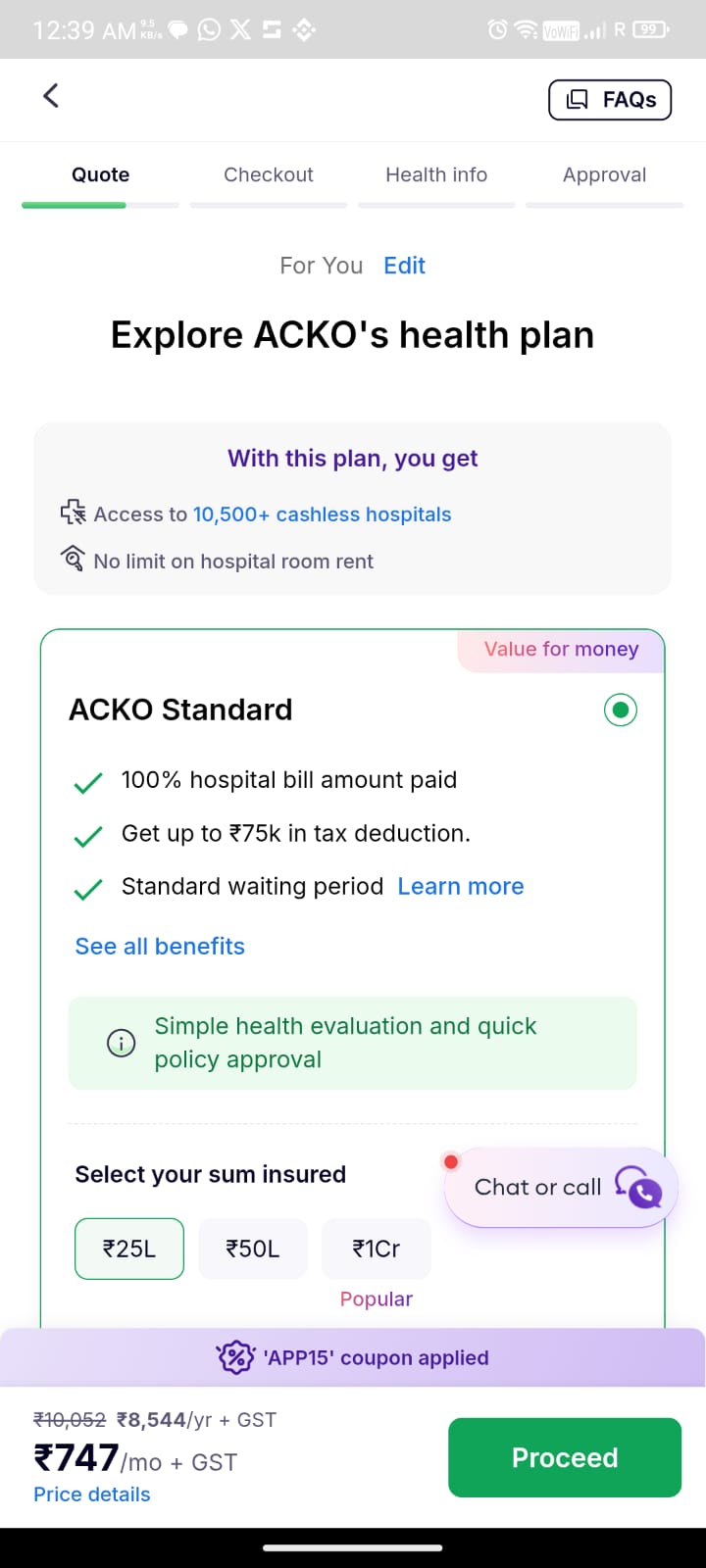

Health Insurance Exploration

- Content: The user navigates to explore Acko’s health plans, seeing a discounted premium ("Flat 15% off", ₹1,508/yr with ‘APP15’ coupon). Benefits include access to 10,500+ cashless hospitals and no limit on hospital room rent.

- Perceived Value:

- Affordability: The 15% discount reduces the premium to ₹1,508/yr, making the plan seem cost-effective.

- Comprehensive Coverage: Access to a large network of cashless hospitals and no room rent limit signals robust coverage, addressing key user concerns (hospital expenses, flexibility).

- Aha Moment: If the user didn’t experience the Aha Moment on the homepage, this could be it. The discounted price combined with clear, valuable benefits (cashless hospitals, no room rent limit) delivers the first core value experience for health insurance.

- Happy Moment: The application of the ‘APP15’ coupon (₹1,508/yr) is a Happy Moment. It provides recurring value by reinforcing the affordability of the plan, making the user feel rewarded for choosing Acko.

As you continue, on the home page, a discount coupon pops up & it's already applied, which also clearly reflects the money saved! An "AHA" moment!.

Health Plan Details

- Content: The user selects a plan (sum insured options: ₹25L, ₹50L, ₹1Cr) and sees detailed benefits of the "Acko Standard" plan: 100% hospital bill coverage, no copay, no room rent limit, 10% added inflation protection, and standard waiting periods (30 days initial, 2 years for specific illnesses, 3 years for pre-existing diseases).

- Perceived Value:

- Transparency: Clear breakdown of benefits (100% bill coverage, no copay) builds trust.

- Financial Security: Features like inflation protection and no copay reduce future financial burdens.

- Flexibility: Multiple sum insured options cater to different needs.

- Aha Moment: If not already experienced, the detailed benefits (e.g., 100% bill coverage, no copay) could be the Aha Moment, as they directly address common pain points in health insurance (out-of-pocket expenses, hidden costs).

- Happy Moment: The ability to customize the sum insured (₹25L, ₹50L, ₹1Cr) is a Happy Moment. It provides recurring value by empowering the user to tailor the plan to their needs, enhancing their sense of control and satisfaction.

Comparison with Market Plans

Comparison with Market Plans

- Content: A comparison table shows why the "Acko Standard Health Plan" is better than other market plans: 100% hospital bill payment (vs. ~85%), no copay (vs. fixed copay), no room rent limit (vs. extra payment for upgrades), 10% added inflation protection (vs. none), and equal waiting periods.

- Perceived Value:

- Superiority: Acko’s plan is positioned as better than competitors, increasing its perceived value.

- Trust: The comparison addresses user concerns (copays, room rent limits), making Acko seem more reliable.

- Aha Moment: For users comparing plans, this could be the Aha Moment. The clear superiority of Acko’s plan over others (e.g., 100% bill coverage vs. 85%) solidifies its value proposition.

- Happy Moment: The reassurance of choosing a better plan (e.g., no copay, inflation protection) is a Happy Moment. It provides recurring value by confirming the user’s decision, reducing buyer’s remorse.

There's also a very clear comparison of advantages and features between Acko & others - eliminates mental blockers of a user

FAQs and Support

- Content: The user sees a "Got questions? Find answers" section with FAQs (e.g., coverage for pre-existing conditions, OPD expenses, maternity) and a "Chat or call" option. There’s also a prompt to upgrade to "Acko Platinum" for better coverage.

- Perceived Value:

- Support: Access to FAQs and live support (chat/call) enhances user confidence.

- Upsell Opportunity: The "Acko Platinum" upgrade suggests even greater value for those seeking premium coverage.

- Happy Moment: The availability of instant support via "Chat or call" and relevant FAQs is a Happy Moment. It provides recurring value by ensuring users can resolve doubts quickly, enhancing their experience and trust in Acko.

The page also addresses FAQs that users might have!

Acko’s Core Value Proposition

“Protect what matters with Acko – affordable, instant insurance that’s simple, fast, and paperless. Get 24-hour claim settlements, 100% cashless coverage, and manage everything from your app, trusted by over 78M users.”

What does Acko will CHARGE for?

- Speed: 24-hour claim settlements.

- Convenience: Paperless, app-based process.

- Affordability: Competitive pricing with loyalty discounts (e.g., NCB, tiered discounts).

- Trust: 78M+ users, 4.6 rating, 100% cashless coverage.

1. Time

- CVP Element: Speed + Convenience

- How It Applies:

- Acko’s 24-hour claim settlements save users significant time compared to traditional insurers, where claims can take 3-15 days. This is critical during emergencies like accidents or health issues.

- The paperless, app-based process eliminates time spent on paperwork, in-person visits, or lengthy renewals, making policy management quick and hassle-free.

- Value Delivered: Users save hours—or even days—on claims and administration, addressing their need for speed and efficiency in a fast-paced world.

2. Output

- CVP Element: Affordability

- How It Applies:

- Acko offers competitive pricing and loyalty discounts (e.g., No Claim Bonus or tiered discounts), ensuring users get financial savings alongside reliable coverage (e.g., 100% cashless claims).

- The tangible output is cost-effective insurance that protects users’ assets (e.g., cars, health) without breaking the bank.

- Value Delivered: Users receive a financial benefit—lower costs and greater savings, making insurance accessible in India’s price-sensitive market.

3. Access

- CVP Element: Convenience + Trust

- How It Applies:

- The app-based platform gives users anytime, anywhere access to buy, manage, and claim insurance, removing barriers like office visits or complex processes.

- Acko’s trust factor (78M+ users, 4.6 rating, 100% cashless coverage) ensures users have access to a reliable, digital-first insurance provider they can depend on.

- Value Delivered: Users gain seamless access to a trusted insurance service, enhancing convenience and peace of mind.

4. Shareability

- CVP Element: Trust

- How It Applies:

- Acko’s strong reputation and digital model enable shareability through referral programs or family insurance plans, allowing users to recommend or extend coverage to others.

- While less central to insurance (which is often personal), trust encourages users to share their positive experiences, amplifying Acko’s reach.

- Value Delivered: Users can share the benefits of Acko’s service with friends or family, though this is a secondary value compared to time or affordability.

To Summarize How This Benefits Acko’s Insurance Service

- Time: By emphasizing speed and convenience, Acko addresses a major pain point in India’s insurance market—slow, cumbersome processes—making it a standout choice for busy users.

- Output: Affordable policies with tangible savings appeal to cost-conscious customers, driving adoption in a competitive landscape.

- Access: A digital-first, trusted platform ensures insurance is accessible to India’s growing smartphone user base, aligning with modern lifestyles.

- Shareability: While less prominent, trust-based sharing supports word-of-mouth growth, reinforcing Acko’s reputation.

With no fixed formula, I’ll explore three strategies—Value-Based Pricing, Penetration Pricing, and Dynamic Pricing, then propose a hybrid approach to optimize revenue.

(Ps: I have hypothesized the numbers of pricing for premiums as a definite price tag is difficult for an insurance product because it depends on the underwriting)

- Car Insurance Market: 10 million potential customers, average premium ₹10,000/year.

- Health Insurance Market: 20 million potential customers, average premium ₹15,000/year.

Pricing Strategy 1: Value-Based Pricing

Concept: Price based on the perceived value to customers, offering tiered plans and rewards for behaviors that align with Acko’s brand (e.g., safe driving, healthy living).

Car Insurance

- Basic Plan: ₹8,000/year (minimal coverage).

- Standard Plan: ₹10,000/year (comprehensive coverage).

- Premium Plan: ₹12,000/year (includes roadside assistance, zero-depreciation cover).

- Discounts: 10% off (₹900) for safe driving via telematics, applied to 50% of customers.

Health Insurance

- Basic Plan: ₹12,000/year (₹5 lakh coverage).

- Standard Plan: ₹15,000/year (₹10 lakh coverage).

- Premium Plan: ₹18,000/year (₹25 lakh coverage, outpatient benefits).

- Discounts: 10% off (₹1,350) for wellness program participation, applied to 40% of customers.

Revenue Calculation

- Car Insurance:

- Market capture: 5% (500,000 customers).

- Assume 40% Basic (200,000), 40% Standard (200,000), 20% Premium (100,000).

- Base revenue: (200,000 × ₹8,000) + (200,000 × ₹10,000) + (100,000 × ₹12,000) = ₹1.6B + ₹2B + ₹1.2B = ₹4.8B.

- Discounts: 50% of 500,000 = 250,000 × ₹900 = ₹225M reduction.

- Net revenue: ₹4.8B - ₹0.225B = ₹4.575B.

- Health Insurance:

- Market capture: 3% (600,000 customers).

- Assume 40% Basic (240,000), 40% Standard (240,000), 20% Premium (120,000).

- Base revenue: (240,000 × ₹12,000) + (240,000 × ₹15,000) + (120,000 × ₹18,000) = ₹2.88B + ₹3.6B + ₹2.16B = ₹8.64B.

- Discounts: 40% of 600,000 = 240,000 × ₹1,350 = ₹324M reduction.

- Net revenue: ₹8.64B - ₹0.324B = ₹8.316B.

- Total Revenue: ₹4.575B + ₹8.316B = ₹12.891B.

Pros: Higher margins on premium plans, aligns with customer value.

Cons: Limited market share growth due to higher base prices.

Pricing Strategy 2: Penetration Pricing

Concept: Set low initial prices to capture market share quickly, then adjust upward over time.

Car Insurance

- Year 1: ₹8,000/year (20% below market average).

- Year 2 Onward: ₹9,500/year (gradual increase).

Health Insurance

- Year 1: ₹12,000/year (20% below market average).

- Year 2 Onward: ₹14,000/year.

Revenue Calculation (Year 1)

- Car Insurance:

- Market capture: 10% (1,000,000 customers) due to low prices.

- Revenue: 1,000,000 × ₹8,000 = ₹8B.

- Health Insurance:

- Market capture: 5% (1,000,000 customers).

- Revenue: 1,000,000 × ₹12,000 = ₹12B.

- Total Revenue: ₹8B + ₹12B = ₹20B.

Year 2 (Assuming 10% Churn)

- Car Insurance: 900,000 × ₹9,500 = ₹8.55B.

- Health Insurance: 900,000 × ₹14,000 = ₹12.6B.

- Total: ₹21.15B.

Pros: Rapid customer acquisition, high volume.

Cons: Lower initial margins, risk of churn when prices rise.

Pricing Strategy 3: Dynamic Pricing

Concept: Use data analytics to set personalized premiums based on real-time risk assessment (e.g., driving habits, health data).

Car Insurance

- Base Premium: ₹10,000/year.

- Adjustment: ±20% based on telematics (e.g., safe drivers pay ₹8,000, risky drivers pay ₹12,000).

- Assumption: 50% low-risk (₹8,000), 30% average (₹10,000), 20% high-risk (₹12,000).

Health Insurance

- Base Premium: ₹15,000/year.

- Adjustment: ±20% based on health data (e.g., ₹12,000 to ₹18,000).

- Assumption: 40% low-risk (₹12,000), 40% average (₹15,000), 20% high-risk (₹18,000).

Revenue Calculation

- Car Insurance:

- Market capture: 5% (500,000 customers).

- Revenue: (250,000 × ₹8,000) + (150,000 × ₹10,000) + (100,000 × ₹12,000) = ₹2B + ₹1.5B + ₹1.2B = ₹4.7B.

- Health Insurance:

- Market capture: 3% (600,000 customers).

- Revenue: (240,000 × ₹12,000) + (240,000 × ₹15,000) + (120,000 × ₹18,000) = ₹2.88B + ₹3.6B + ₹2.16B = ₹8.64B.

- Total Revenue: ₹4.7B + ₹8.64B = ₹13.34B.

Pros: Optimized revenue per customer, leverages Acko’s tech edge.

Cons: Complex to implement, potential regulatory hurdles.

Hybrid Approach: Combining the Best

Concept: Start with Penetration Pricing to gain customers, transition to Dynamic Pricing for personalization, and add Value-Based elements like bundling (10% discount for buying both products).

Year 1 (Penetration)

- Car: ₹8,000, 1,000,000 customers = ₹8B.

- Health: ₹12,000, 1,000,000 customers = ₹12B.

- Bundling: 30% (300,000) buy both at ₹18,000 (₹7,200 + ₹10,800).

- Bundled revenue: 300,000 × ₹18,000 = ₹5.4B.

- Remaining: 700,000 × ₹8,000 = ₹5.6B (car), 700,000 × ₹12,000 = ₹8.4B (health).

- Total: ₹5.4B + ₹5.6B + ₹8.4B = ₹19.4B (slightly less due to discounts, but assume higher acquisition: 1,200,000 each, total ₹23.2B).

Year 2 (Dynamic + Value)

- Retention: 90% (1,080,000 each), new customers 200,000 each.

- Car: 540,000 × ₹8,800 (low), 324,000 × ₹11,000 (avg), 216,000 × ₹13,200 (high) = ₹11.79B.

- Health: 432,000 × ₹13,200, 432,000 × ₹16,500, 216,000 × ₹19,800 = ₹17.13B.

- Total: ₹28.92B.

Summary in Tabular Format

Strategy | Description | Car Premium | Health Premium | Year 1 Revenue | Year 2 Revenue | Pros | Cons |

|---|---|---|---|---|---|---|---|

Value-Based | Tiered plans, behavior discounts | ₹8,000-₹12,000 | ₹12,000-₹18,000 | ₹12.89B | - | Higher margins, customer value | Slower market growth |

Penetration | Low prices, then increase | ₹8,000 (Y1), ₹9,500 | ₹12,000 (Y1), ₹14,000 | ₹20B | ₹21.15B | High volume | Low margins, churn risk |

Dynamic | Personalized, data-driven | ₹8,000-₹12,000 | ₹12,000-₹18,000 | ₹13.34B | - | Optimized revenue | Complexity, regulatory risk |

Hybrid | Penetration → Dynamic + Bundling | ₹8,000-₹13,200 | ₹12,000-₹19,800 | ₹23.2B | ₹28.92B | Balances growth & revenue | Requires execution precision |

Given Acko’s nature as an insurance company with dynamic premiums and coverage, I’ve analyzed the existing pricing for various insurance & analyzed the design in the proposed a redesign, and provided reasoning for the changes.

Analysis of Existing Pricing Pages - I have taken the pricing part of the 2 insurance policies (Health & Bike)

HEALTH PLAN

Health Insurance Pricing Page

The screenshot shows a pricing details popup with a breakdown of the premium, discounts, and total cost.

Current Design Elements:

- Pricing Breakdown:

- Yearly premium: ₹10,052.45

- Discount ("APP15" applied): ₹8,544.59

- GST (18%): ₹1,538.02

- Total: ₹10,082.61/year (or ₹882.22/month)

- Additional Information:

- Note: Discount applies yearly.

- Monthly payment option available.

- CTA (Call to Action):

- Green "Okay" button to confirm and proceed.

- Context:

- Part of the "Explore Acko’s Health Plan" flow, with tabs like "Quote," "Checkout," "Health Info," and "Approval."

Strengths:

- Transparency: Detailed breakdown of premium, discount, and GST builds trust.

- Flexibility: Monthly payment option caters to varied budgets.

- Clarity: Note about recurring discounts ensures user understanding.

Weaknesses:

- Static Display: Pricing is presented as a final figure without interactive elements.

- CTA Visibility: "Okay" button lacks emphasis, potentially reducing conversion.

- Lack of Context: Users may not see how inputs (e.g., age, coverage) affect the price.

Purpose of Current Design:

- Trust Building: Clear cost breakdown addresses user skepticism in insurance purchases.

- Simplification: Static popup ensures users focus on the final cost without distractions.

- Progression: Part of a guided flow to keep users moving toward purchase.

Redesigning the page

Redesigned Layout:

- Header:

- "Your Health Plan Price Breakdown" with a progress bar (e.g., Quote → Customize → Checkout).

- Interactive Calculator Section:

- Inputs: Age, number of family members, pre-existing conditions (dropdowns).

- Live Update: Premium adjusts in real time (e.g., "Base: ₹10,052 → ₹12,000 with family").

- Pricing Card:

- Breakdown:

- Base Premium: ₹10,052.45

- Discount ("APP15"): -₹1,507.86 (15% off)

- Net Amount: ₹8,544.59

- GST (18%): ₹1,538.02

- Total: ₹10,082.61/year (or ₹882.22/month)

- Toggle: Switch between yearly/monthly pricing.

- Discount Section:

- "Applied: APP15 (₹1,507 saved)" with an "Add Coupon" field.

- Educational Tooltips:

- Hover on "GST" or "Net Amount" for explanations (e.g., "GST is an 18% tax on the net premium").

- CTA:

- Bright orange "Proceed to Checkout" button with a smaller "Edit Plan" link.

- Colors: Green for savings, orange for CTA, neutral gray for informational text.

Reasoning for the Redesign

- Interactive Calculator:

- Why: Allows users to see how their inputs (e.g., family size) affect pricing, reflecting Acko’s dynamic pricing model.

- Impact: Enhances transparency and control, reducing purchase hesitation.

- Pricing Toggle:

- Why: Yearly vs. monthly view caters to different budgeting preferences.

- Impact: Increases flexibility, appealing to a broader audience.

- Educational Tooltips:

- Why: Terms like GST can confuse users; tooltips educate without clutter.

- Impact: Boosts confidence, especially for first-time buyers.

- Bold CTA:

- Why: Orange "Proceed to Checkout" grabs attention over the neutral "Okay."

- Impact: Drives higher conversions by guiding users clearly.

BIKE INSURANCE

Bike Insurance Pricing Page

The screenshot shows a screen with bike insurance options, including tenure, plan types, and pricing.

Current Design Elements:

- Vehicle Details:

- IDV (Insured Declared Value): ₹62,500 (editable).

- Tenure Options:

- 1 Year, 2 Years (Save ₹154), 3 Years (Save ₹404).

- Plan Types:

- Comprehensive Plan: ₹1,953 (covers bike damage, third-party liability, cashless claims at 5400+ garages).

- Own Damage Plan: ₹587 (covers bike damage, cashless claims).

- Discount:

- "APP150" applied, saving ₹150.

- Total Cost:

- ₹1,953 + 18% GST for Comprehensive Plan.

- CTA:

- Green "Continue" button.

Strengths:

- Customization: Editable IDV and tenure options reflect dynamic pricing.

- Incentives: Tenure-based savings encourage longer commitments.

- Service Highlight: Cashless claims at 5400+ garages add value.

Weaknesses:

- Lack of Interactivity: Premium doesn’t update live as users adjust options.

- Minimal Breakdown: GST is mentioned, but no detailed cost split.

- Feature Overlap: Plan differences (e.g., third-party liability) aren’t visually distinct.

Purpose of Current Design:

- Flexibility: Editable fields allow tailored pricing for diverse users.

- Value Perception: Savings on longer tenures nudge users toward higher-value plans.

- Simplicity: Single-screen flow minimizes friction in decision-making.

Redesigning the page

- Header:

- "Customize Your Bike Insurance Plan" with a progress bar (Vehicle → Coverage → Add-ons).

- Step 1: Vehicle Details (Collapsible):

- Inputs: Make, model, year, registration number.

- IDV Slider: ₹50,000–₹100,000 (default: ₹62,500).

- Live IDV impact on premium (e.g., "IDV: ₹62,500 → Premium: ₹1,953").

- Step 2: Coverage Selection:

- Plan Cards:

- Comprehensive: ₹1,953 (Icons: Bike Damage, Third-Party, Cashless Claims).

- Own Damage: ₹587 (icons: Bike Damage, Cashless Claims).

- Tenure Tabs:

- 1 Year: ₹1,953 | 2 Years: ₹3,752 (Save ₹154) | 3 Years: ₹5,450 (Save ₹404).

- Step 3: Add-ons & Discounts:

- Checkboxes: Zero Depreciation (+₹300), Roadside Assistance (+₹150).

- Discount Field: "APP150" applied (₹150 off).

- Live Total: ₹1,953 → ₹2,253 (with add-ons) → ₹2,103 (after discount).

- Pricing Summary:

- Base: ₹1,953 | Add-ons: ₹300 | Discount: -₹150 | GST (18%): ₹351 | Total: ₹2,454.

- CTA:

- Bright orange "Proceed to Payment" button.

Visual Elements:

- Colors: Green for savings/add-ons, orange for CTA, blue for tenure tabs.

Reasoning for the Redesign

- Wizard Flow with Progress Bar:

- Why: Breaks down decisions (vehicle → coverage → add-ons) into manageable steps.

- Impact: Reduces cognitive load, improving user experience.

- IDV Slider with Live Updates:

- Why: Immediate premium adjustments as IDV changes show pricing logic.

- Impact: Builds trust through transparency and interactivity.

- Visual Plan Cards:

- Why: Icons and clear differentiation make plan benefits scannable.

- Impact: Simplifies decision-making for non-expert users.

- Tenure Savings Visualization:

- Why: Highlighting savings (e.g., "Save ₹404") encourages longer tenures.

- Impact: Increases customer lifetime value for Acko.

- Add-ons and Discounts:

- Why: Live updates on add-ons and discounts clarify cost impacts.

- Impact: Encourages upselling (add-ons) and conversions (discounts).

Summary Table: Key Changes and Benefits

Section | Original Feature | Redesigned Feature | Benefit |

|---|---|---|---|

Health - Pricing | Static breakdown (₹10,082.61) | Interactive calculator + toggle | Transparency, user control |

Health - CTA | Green "Okay" button | Orange "Proceed to Checkout" | Higher visibility, better conversion |

Bike - Flow | Single screen, static | Wizard with progress bar | Reduced complexity, guided process |

Bike - Pricing | No live updates | IDV slider, live premium updates | Transparency, interactivity |

Bike - Plans | Text-based plan details | Visual cards with icons | Easier comprehension, faster choice |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.